Los Angeles County’s Sales Tax Rate to Increase Measure M will Take Effect July 1

Los Angeles County’s Sales Tax Rate to Increase

Measure M will Take Effect July 1

Sacramento – The half-cent sales tax increase approved by Los Angeles County voters in November 2016 – Measure M – will go into effect on July 1, 2017. The increase will apply to every city and unincorporated area of Los Angeles County, bringing the countywide sales and use tax rate to 9.25 percent.

“The sales tax increase enacted by the passage of Measure M, the Los Angeles County Traffic Improvement Plan, proposes to improve freeway traffic flow and safety, repair streets and sidewalks, synchronize traffic signals, earthquake-retrofit bridges, expand public transit systems, create jobs, and keep fares affordable for seniors, students, and the disabled,” said Board of Equalization Member Jerome Horton.

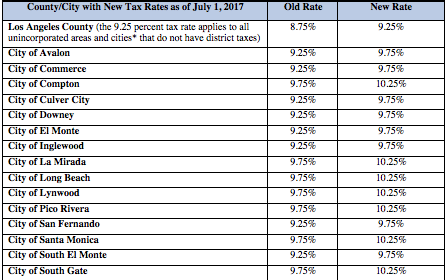

Fifteen cities within Los Angeles County have special district taxes. The chart below lists the new tax rates for the cities of Avalon, Commerce, Compton, Culver City, Downey, El Monte, Inglewood, La Mirada, Long Beach, Lynwood, Pico Rivera, San Fernando, Santa Monica, South El Monte, and South Gate.

* Agoura Hills, Alhambra, Arcadia, Artesia, Azusa, Baldwin Park, Bell, Bell Gardens, Bellflower, Beverly Hills, Bradbury, Burbank, Calabasas, Carson, Cerritos, City of Industry, Claremont, Covina, Cudahy, Diamond Bar, Duarte, El Segundo, Gardena, Glendale, Glendora, Hawaiian Gardens, Hawthorne, Hermosa Beach, Hidden Hills, Huntington Park, Irwindale, La Canada-Flintridge, La Habra Heights, La Puente, La Verne, Lakewood, Lancaster, Lawndale, Lomita, Los Angeles, Malibu, Manhattan Beach, Maywood, Monrovia, Montebello, Monterey Park, Norwalk, Palmdale, Palos Verdes Estates, Paramount, Pasadena, Pomona, Rancho Palos Verdes, Redondo Beach, Rolling Hills, Rolling Hills Estates, Rosemead, San Dimas, San Gabriel, San Marino, Santa Clarita, Santa Fe Springs, Sierra Madre, Signal Hill, South Pasadena, Temple City, Torrance, Vernon, View Park, Walnut, West Covina, West Hollywood, Westlake Village, and Whittier

To find the correct tax rate for your area or business location, visit the BOE’s website and click the Find a SALES TAX RATE by Address button, or visit the California City & County Sales and Use Tax Rates page. (Please note: This new rate will not be available on the website until July 1, 2017.) You can also call the Customer Service Center at 1-800-400-7115 (TTY:711). Customer service representatives are available to assist you weekdays from 8:00 a.m. to 5:00 p.m. (Pacific time), except state holidays.

Re-elected in 2014, Jerome E. Horton is the Third District Member of the California State Board of Equalization (BOE), representing more than 9.5 million residents in Los Angeles, Ventura, and San Bernardino counties. He is also the BOE’s Property Tax Committee Chairman. He is the first to serve as a Board Member with more than 21 years of experience at the BOE. Horton previously served as a Member of the California State Assembly from 2000-2006.